2022 Nebraska Farmland Values and Cash Rent Rates

April 22, 2022

| AgFocus-Ag Focus

|

All of us at Security Bank wish you a safe planting season! Last month we touched on the relationship between land values and interest rates. To follow up on land values specifically, this month we are forwarding the preliminary UNL survey findings that was published on March 16th. All of us at Security Bank wish you a safe planting season! Last month we touched on the relationship between land values and interest rates. To follow up on land values specifically, this month we are forwarding the preliminary UNL survey findings that was published on March 16th.

|

CORNHUSKER ECONOMICS: 2022 NEBRASKA FARMLAND VALUES AND CASH RENTAL RATES

By Jim Jansen and Jeff Stokes, UNL

The market value of agricultural land in Nebraska increased by 16% over the prior year, according to the 2022 Nebraska Farm Real Estate Market Survey. This marks the largest increase in the market value of agricultural land in Nebraska since 2014 and is the highest non-inflation-adjusted state-wide land value in the history of the survey.

As part of the annual survey, land industry professionals reported the rise in Nebraska agricultural land values were attributed to higher commodity prices, interest rates near historic lows, hedging against inflation, and a renewed use in 1031 exchanges. The financial position of many operations improved over the prior year despite rising machinery costs and input expenses. Attractive interest rate levels created a strong market as investors turned to land as a tangible investment. Proposed capital gains tax changes also spurred usage of 1031 exchanges.

COVID-19 relief policy led to federal disaster assistance for the agricultural sector, along with an extended period of low interest rates. The tapering back of disaster assistance was offset by higher crop and livestock income across Nebraska in 2021 (Lubben, 2022). The outlook for 2022 also appears favorable as commodity prices continue to rise, but the impact of higher input costs and intensifying drought across the state are causes for concern (Kauffman & Kreitman, 2022).

Overseas conflict leading to input shortages and higher expenses remains a challenge for navigating 2022. Favorable financial positions, lending terms, and stability of land as an investment, created a competitive real estate market across Nebraska.

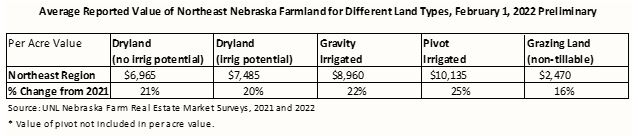

Cropland represented the highest market value increase for Nebraska for 2022 compared to 2021. The estimated market value of dryland cropland with irrigation potential rose by 19% across the state. Districts in the Northeast, East, and Southeast increased by about 18% to 24%. Dryland cropland without irrigation potential followed similar trends as the Northwest, Northeast, Central, and East, reporting increases from 15% to 21%. Center pivot irrigated cropland averaged 17% higher year over year, with the Northwest, Northeast, Southwest, and Southeast leading the state between 18% and 24%. Gains in the hay land and grazing land markets range from 10% to 13%.

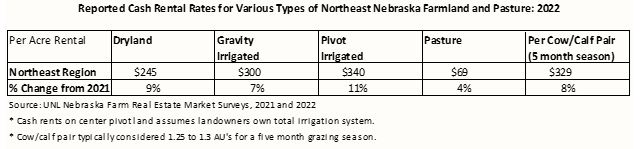

Cropland cash rental rates trended higher in 2022 over the prior year. Higher crop prices and spring crop insurance price guarantees were reasons cited despite higher input costs. Overseas conflict has disrupted trade patterns for commodities and critical crop inputs.

Dryland and irrigated cropland cash rental rates in 2022 averaged about 10% to 15% higher than the prior year. Irrigated cash rental rates assume that the landlord owns the entire irrigation system. These rates would be adjusted down to reflect the tenant providing a component to the irrigation system. Extensive drought and heightened input expenses such as fertilizer and crop chemicals were reported as concerns expressed by survey participants for the upcoming growing season.

Grazing land and cow-calf pairs rental rates trended steady to higher across Nebraska in 2022. These rates increased about 6% to 8% over the prior year. Drought poses a concern over the upcoming growing season. Negotiating early removal provisions should be accounted for as part of the cash rental rate subject to drought conditions. Factors also may include the responsibility of fencing upkeep, weed control, and utility bills associated with livestock wells.

Land values and rental rates presented in this report are averages of survey participants’ responses by district. Actual land values and rental rates may vary depending upon the quality and local market. Also, preliminary land values and rental rates are subject to change as additional surveys are returned. Final results from the survey will be published in June 2022 and available via the Nebraska Land values and rental rates presented in this report are averages of survey participants’ responses by district. Actual land values and rental rates may vary depending upon the quality and local market. Also, preliminary land values and rental rates are subject to change as additional surveys are returned. Final results from the survey will be published in June 2022 and available via the Nebraska Farm Real Estate website: http://cap.unl.edu/realestate. Please address questions regarding preliminary to Jim Jansen at (402) 261-7572 or [email protected].