Streamlining Your Finances: Bookkeeping Best Practices

June 26, 2024

| AgFocus-Ag Focus | BusinessFocus-Business Focus | BankingFocus-Bank News

|

June has brought so much welcome rain. It is hard to believe we are halfway through 2024. As we all know, time will continue to move forward. Utilizing your rainy days to catch up on bookkeeping might save you some stress come fall/winter. Here are some of our best practice tips for small business bookkeeping. June has brought so much welcome rain. It is hard to believe we are halfway through 2024. As we all know, time will continue to move forward. Utilizing your rainy days to catch up on bookkeeping might save you some stress come fall/winter. Here are some of our best practice tips for small business bookkeeping.

|

5 Essential Bookkeeping tips for Small Businesses

Efficient bookkeeping is crucial for the success of any small business. Proper financial management helps ensure profitability, facilitates growth, and keeps the business compliant with tax laws. Here are five essential tips to help small businesses maintain accurate and effective bookkeeping practices.

1. Separate Personal and Business Finances

Mixing personal and business finances can lead to confusion and errors. Open a dedicated business bank account and use it exclusively for business transactions. This separation simplifies tracking expenses and income.

2. Use Accounting Software

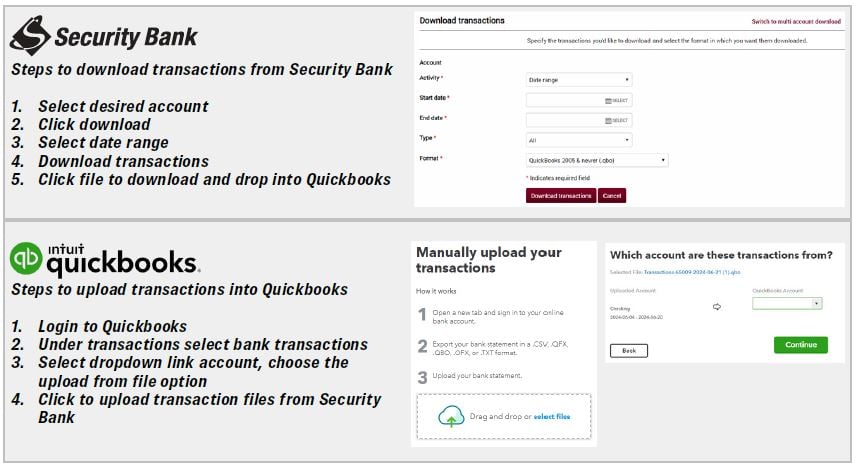

Invest in reliable accounting software like QuickBooks. These tools streamline the bookkeeping process, automate repetitive tasks, and provide valuable insights through financial reports.

3. Track Expenses Diligently

Keep detailed records of all business expenses. Categorize them correctly to ensure accurate financial statements and simplify tax preparation. Save receipts and invoices digitally for easy access and backup.

4. Regularly Reconcile Bank Accounts

Reconcile your bank statements with your accounting records at least monthly. This practice helps identify discrepancies, prevent fraud, and ensure the accuracy of your financial data.

5. Maintain a Consistent Schedule

Set aside regular time each week or month for bookkeeping tasks. Consistency helps avoid backlog, reduces stress, and ensures that your financial records are always up to date.

Bonus: Outsource

It is essential to have accurate bookkeeping records. As small business owners you wear many hats and hold numerous responsibilities. If bookkeeping isn’t your passion and you’d feel relieved to remove the responsibility from your workload, then it’s time to explore the idea of outsourcing your bookkeeping with Security Bank. We have the tools and resources to ensure your bookkeeping is up to date and accurate.

By following these five tips, small business owners can maintain accurate and efficient bookkeeping practices, leading to better financial management and long-term success. Consistent, careful bookkeeping not only keeps you compliant with regulations but also provides a clear picture of your business’s financial health, enabling informed decision-making and strategic planning.