It is interesting to see how changes in long-term interest rates affect things like land values, for example. Speaking of investors, whether you own land to farm, or to rent it out, you are an investor as well. No matter what you do with farmland, you are looking for some level of return. There are two ways to look at a given rate attached to a tract of land. You can either look at the interest rate as a rate of return, or as the cost to borrow for a portion of the land. In either case, the rate of return and/or the rate paid for borrowing a portion of the cost, among other factors, can influence one’s decision on how much to pay for land, collect for cash rent, etc. Multiply this across the entire farm belt, and you start seeing trends in land prices/values.

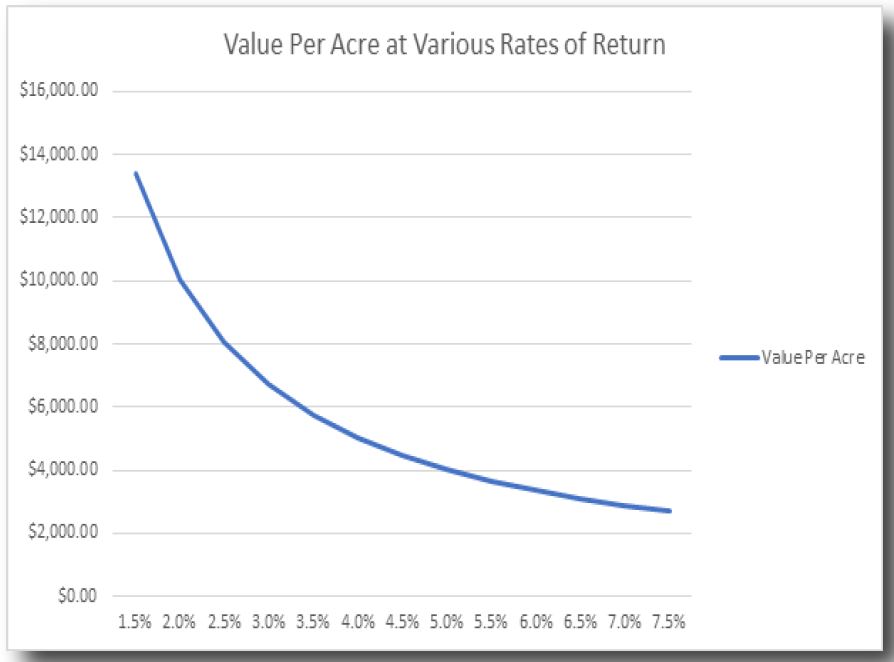

The best way to illustrate is with an example. Assume 160 irrigated acres that would rent for $285. Total revenue would be $45,600. Subtract off the top costs for insurance, land taxes, and some maintenance costs—let’s say $13,400, which leaves $32,200 net rental revenue. The chart below shows what a per acre land value might be at various rates of return based on $32,200 revenue from a farm. Remember, you would say the same thing about revenue from farming the tract as well. Dollar amount of return is dollar amount of return.

Using examples from the chart above, the revenue figure of $32,200 divided by, for example, a capitalization rate (rate of return) of 2.0% suggests a farm value of $1,610,000, or $10,062.50 per acre. So, assuming this dollar amount of revenue (based on a $285/ac rent), and as an investor you want to see a 2.0% return, you would not pay more than $10,062 per acre to achieve that result. Looking at the same example, but at the other end of the spectrum, say at a rate of return of 6.0%, that suggests a land value of $536,667 (assuming the same revenue figure), which means you would not pay more than $3,350 per acre to achieve a 6.0% return from $32,200 of net revenue.

Borrowing cost can influence the decision of how much to pay and therefore play a role in determining land values also. For a simplified example, assume one is buying that 160-acre farm and pledging another they already own as additional collateral (two farms to finance one farm, which equates to 50% financing). Assuming a price of $8,000 per acre, that payment over 30 years and 4.5% interest rate is $78,581 or about $245 per acre. What if that long-term rate was three percentage points higher at the time of purchase? Then that payment would be $108,379 or about $340 per acre used as collateral (320 acres). Could a difference such as that influence one’s decision to buy the farm? For some, it may very well result in passing up the opportunity. If most buyers were of that opinion, then at the higher interest rate environment, the land simply may not sell for $8,000 per acre and could likely sell for something less that would result in a more desirable payment for cash flow purposes or in comparing to the current cash rent environment. The chart for interest rates on borrowed money would look similar to the rate of return chart above.